Forest Tax Rates

Landowners with land in the Managed Forest Law (MFL) and Forest Crop Law (FCL) programs pay MFL and FCL tax rates in lieu of regular property tax rates.

MFL tax rates (per acre)

The current MFL tax rates were calculated in 2022 for use in 2023 through 2027.

- Land entered before 2005 (1987 - 2004)

- Open land (acreage share tax): $0.72

- Closed land (acreage share tax plus $.96 closed acreage fee): $1.68

- Land entered after 2004 (2005 and later)

- Open land (acreage share tax): $1.90

- Closed land (acreage share tax plus $7.59 closed acreage fee): $9.49

FCL tax rates (per acre)

The current FCL tax rates were calculated in 2022 for use in 2023 through 2032.

- FCL rate: $3.60

FCL and MFL limited application tax (stumpage) rates

The department uses stumpage values in the assessment of MFL withdrawal taxes in some limited circumstances, and in enforcement situations for determining penalty amounts for cutting merchantable timber in violation of s. 77.86 (and s. 77.06), Wis. Stats.

The following rates are effective Nov. 1, 2025 to Oct. 31, 2026. The rates are listed by product and species. All values are statewide three-year weighted averages calculated using state and county timber sale data.

If a cell is marked as N/A, the species/product is not normally harvested.

| Tree Species/Product | Logs (1) | Cord Products (2) | Cord Products by Weight (3) | Cord Products Mixed with fine Woody Material (4) | Mixed Products (5) |

|---|---|---|---|---|---|

| Ash | $216.68 | $11.19 | $4.47 | $9.67 | $6.63 |

| Aspen | $37.18 | $45.78 | $21.44 | $42.98 | $28.89 |

| Basswood | $154.37 | $8.10 | $29.30 | N/A | $7.99 |

| Birch, White | $172.11 | $24.09 | $9.51 | $20.12 | N/A |

| Birch, Yellow | $194.41 | N/A | N/A | N/A | N/A |

| Cedar | $50.00 | $23.95 | $3.99 | N/A | N/A |

| Cherry | $193.02 | N/A | $8.06 | N/A | N/A |

| Elm | $75.00 | N/A | N/A | N/A | N/A |

| Fir | N/A | $13.38 | $9.25 | $9.23 | $5.00 |

| Hemlock | N/A | $5.00 | $3.75 | N/A | N/A |

| Hickory | $113.82 | $10.00 | N/A | N/A | N/A |

| Maple, Sugar | $365.86 | $19.06 | N/A | N/A | N/A |

| Maple, Red | $263.69 | $24.51 | $10.01 | $40.00 | $6.00 |

| Maple, Other | $231.33 | N/A | $5.50 | N/A | N/A |

| Mixed Hardwoods | $200.97 | $22.48 | $21.96 | $22.79 | $16.33 |

| Oak, Red | $358.81 | $24.82 | $8.30 | $12.00 | $27.39 |

| Oak, White | $463.77 | N/A | $8.67 | N/A | N/A |

| Oak, Other | $261.68 | $28.92 | $8.73 | N/A | $15.43 |

| Pine, Jack | N/A | $32.35 | $13.07 | $7.04 | $6.90 |

| Pine, Red | $161.62 | $57.28 | $22.75 | $67.99 | $39.91 |

| Pine, White | $136.56 | $15.92 | $13.11 | $30.00 | $20.10 |

| Spruce | N/A | $16.85 | $15.99 | N/A | $15.46 |

| Tamarack | N/A | $15.81 | $4.31 | N/A | $9.46 |

| Black Walnut | $2,587.51 | N/A | N/A | N/A | N/A |

(1) Stumpage values in dollars per thousand board feet measurement by the Scribner Decimal C log rule.

(2) 128 cubic feet of wood, air and bark assuming careful piling. Values shown in dollars per cord.

(3) Stumpage value in dollars per ton.

(4) Stumpage value in dollars per cord.

(5) Cord products combined with logs and bolts by weight (stumpage value in dollars per ton). Stumpage values used to calculate withdrawal taxes during any specific period are intended for the purposes of the Forest Crop Law and Managed Forest Law. They are not a guarantee of actual market prices and are not intended for use in timber products valuation. Actual market prices can fluctuate, both up and down, and are the product of macro and

micro-economic conditions reflecting specific factors of each individual sale.

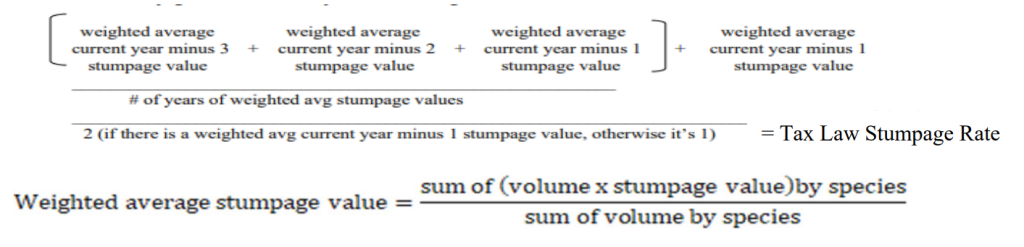

(6) The following image shows the formula used to calculate the three-year weighted average.