Financial Resources for Cleaning Up & Redeveloping Contaminated Properties

Many financial resources, tools and incentives exist to help investigate, clean up and redevelop contaminated properties in Wisconsin.

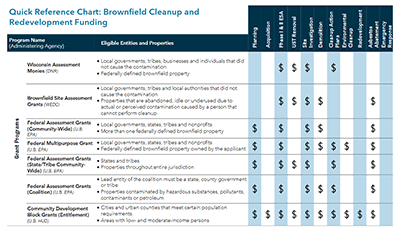

The DNR's Quick Reference Chart: Cleanup and Redevelopment Funding (RR-077) summarizes resources available through state, federal and local programs.

DNR Resources

The DNR administers two financial programs funded through grants from the U.S. Environmental Protection Agency for the investigation and cleanup of brownfields.

- Wisconsin Assessment Monies (WAM) - support for Phase I Environmental Site Assessments, Phase II Environmental Site Assessments, site investigations and cleanup planning.

- Ready for Reuse Loan and Grant Program - support for cleanup planning and remediation.

The Dry Cleaner Environmental Response Fund is a reimbursement program for cleanup activities at eligible dry cleaning facilities.

The DNR's Knowles Nelson Stewardship Program was established to preserve valuable natural areas and wildlife habitat, protect water quality and fisheries and expand opportunities for outdoor recreation.

Wisconsin Economic Development Corporation Resources

Programs administered by the Wisconsin Economic Development Corporation (WEDC) are often used in tandem with the DNR's WAM program to fund assessment, demolition and cleanup of contaminated sites.

- Brownfields Site Assessment Grant

- Brownfields Grant Program

- Idle Sites Redevelopment Program

- Community Development Investment Grant Program

- Vibrant Spaces Grant

Contact WEDC directly for additional information and eligibility criteria.

Other State Resources

- Board of Commissioners of Public Lands: State Trust Fund Loans

- Department of Administration: Wisconsin Coastal Management Grants

- Department of Administration: Community Development Block Grant Program (CDBG)

- Department Of Agriculture, Trade and Consumer Protection: Agricultural Chemical Cleanup Program (ACCP)

- Department of Transportation: Economic Assistance Program (TEA) Grants

- Department of Transportation: Local Transportation Enhancement

Federal Resources

The U.S. Environmental Protection Agency's Brownfield Funding supports the assessment and cleanup of contaminated properties through assessment, multipurpose and revolving loan fund grants. Job training and technical assistance grants are also available.

- A state letter of acknowledgment or petroleum eligibility determination from the DNR is required when applying for a federal grant.

- Applicants may also contact Kansas State University's Technical Assistance for Brownfields (TAB) program for free assistance with grant applications and other technical assistance.

The Section 108 Loan Guarantee Program is a section of the U.S. Department of Housing and Urban Development's Community Development Block Grant Program. It allows local governments to borrow five times their block grant allocation.

Small businesses may be eligible for assistance through loans backed by the U.S. Small Business Administration (SBA) through SBA loan programs.

Tax Tools

Tax Delinquency Tools

Under state laws, local governments have options to manage contaminated properties with delinquent taxes, including direct acquisition, partnership with a third party who will acquire the property, and cancelation of all or portions of the delinquent taxes (see § 75.17, § 75.106, § 75.105, Wis. Stats.).

Tax Incremental Financing

Tax incremental financing (TIF) is a public financing method used by local governments to fund redevelopment and infrastructure improvement projects within a geographical area (see § 66.1105, Wis. Stats.).

After a tax incremental district (TID) is certified by the Wisconsin Department of Revenue, a municipality may issue debt (borrow money) to fund the acquisition of land, infrastructure improvements, building demolition, environmental work and more within the TID.

An Environmental Remediation (ER) TID may be created when most of the TID contains significant environmental pollution. A municipality pursuing DNR review and certification of a site investigation report for a proposed ER TID should use DNR Form 4400-237 for assistance.

Tax Credits

Historic Preservation Income Tax Credits are available on state and federal income taxes for rehabilitation expenses at qualifying properties.

The New Market Tax Credit Program, managed by the U.S. Department of the Treasury's Community Development Financial Institutions Fund, incentivizes community development and economic growth by using tax credits to attract private investment to distressed communities.